Analysis of the Currency Structure between China and the United States#

China and the United States have some significant differences in their currency supply structures, which mainly stem from the different economic development models, financial system structures, and monetary policy objectives of the two countries. The following is a specific comparative analysis of the differences in currency structure between China and the United States from aspects such as the composition of currency supply structure, currency issuance mechanisms, monetary policy tools, and characteristics:

1. Hierarchical Composition of Currency Supply (M0, M1, M2)#

China:

- M0 (Cash in circulation):

China has a relatively high usage of cash, especially in rural areas and small businesses, where cash remains an important payment tool. However, with the widespread adoption of mobile payments (such as WeChat Pay and Alipay), the growth rate of cash circulation has slowed.

- M1 (M0 + Corporate demand deposits):

China has a high proportion of demand deposits, reflecting a strong savings tendency among enterprises and residents. The growth rate of M1 is often seen as an indicator of economic activity.

- M2 (M1 + Time deposits, household savings deposits, and other quasi-money):

China's M2 is enormous and has long maintained the top position globally. Due to the strong savings habits of the Chinese people and the diversification of financial products (such as wealth management products and trust products), the broad money supply is very large.

[ps]: Proposed by the "Hefei Central Branch of the People's Bank of China" in March 2014 in the article "The Three Brothers of Money Supply: M0, M1, M2" which established the boundary standard for the Renminbi.

United States:

- M0 (Cash in circulation):

Cash accounts for a relatively small proportion in the U.S., which relies more on the banking system and electronic payments. Cash mainly circulates among low-income groups and in small transactions.

- M1 (M0 + Demand deposits + Check deposits + Traveler's checks):

The proportion of M1 in the U.S. has significantly increased in recent years, partly due to the liquidity released by a large number of economic stimulus policies after the pandemic, leading to a rapid increase in demand deposits.

- M2 (M1 + Savings + Time deposits not exceeding $100,000 + Money market funds):

Although the scale of M2 in the U.S. has grown rapidly, its "penetration rate" (M2/GDP) is significantly lower than that of China, which is related to the developed capital markets in the U.S., lower savings tendencies, and more funds entering the financial investment market.

- M3 (M2 + Large time deposits over $100,000)

[ps]: Standards disclosed on the Federal Reserve's official website.

2. Characteristics of Currency Supply#

The growth rate of M2 is often used to observe and regulate medium- to long-term changes in the financial market, and it is also one of the important indicators reflecting changes in total social demand and future inflationary pressures.

Since 2008, China's M2 has shown a trend of rapid growth, while the growth of M2 in the U.S. has been relatively stable. This is mainly due to China's rapid economic growth and loose monetary policy. The U.S. also adopted a loose monetary policy after the pandemic in 2020, stimulating economic growth through excessive issuance of currency.

China:

•High M2/GDP ratio:

In recent years, China's M2 to GDP ratio has exceeded 200%, reflecting a relatively loose monetary supply, partly due to the financial system being dominated by banks, with funds accumulated through credit.

•Driven mainly by domestic demand:

China's currency supply mainly serves domestic economic activities, with external factors such as international capital flows and dollar liquidity having a relatively small impact.

United States:

•Low M2/GDP ratio:

The M2 to GDP ratio in the U.S. typically ranges between 60% and 100%, reflecting a developed financial market where funds circulate more through capital markets rather than the banking system.

•Significant external demand influence:

As a global reserve currency, the supply of dollars is influenced by international capital flows, especially the demand from other countries for dollar assets (such as U.S. Treasury bonds).

Summary and Insights

•China relies more on a credit-driven currency supply model, with the central bank having strong direct control over commercial banks and money supply. Monetary policy tends to adjust through quantitative tools.

•The U.S. currency supply is primarily based on market mechanisms, with the Federal Reserve influencing money supply through interest rate tools and capital markets. The international monetary status of the dollar gives the U.S. greater policy flexibility.

3. Currency Issuance Mechanism#

China:

- Central Bank Dominance:

China's currency supply is directly controlled by the People's Bank of China (PBOC). Currency issuance heavily relies on the central bank's monetary policy and credit orientation.

Base money (M0) is also known as high-powered money, which is the most basic form of currency in the monetary system. It includes cash in circulation (banknotes and coins) and commercial banks' deposits at the central bank (i.e., reserves).

China's base money is issued by the People's Bank of China, mainly through two methods:

-

Foreign Exchange Occupation: China has large foreign exchange reserves, and when the central bank purchases foreign exchange, it directly injects Renminbi as base money.

-

Central Bank Operations: Adjusting the amount of base money through open market operations (such as reverse repos, central bank bills, etc.).

The scale of base money is usually influenced by external economic factors (such as international trade, foreign exchange reserves) and domestic monetary policy. In recent years, China's base money scale has been relatively stable, but due to the rapid growth of broad money (M2), the relative scale of base money is small.

- Central Bank Characteristics: Credit-driven

China's currency supply is primarily driven by credit expansion, with bank credit playing a central role in money creation, and the lending behavior of commercial banks directly affecting the total amount of money supply.

- Impact of Foreign Exchange Reserves:

For a long time, China's large foreign exchange reserves (resulting from trade surpluses) have influenced money supply. The central bank purchases dollars through "foreign exchange occupation" to balance the exchange rate, while injecting Renminbi to expand the base money supply.

United States:

- Federal Reserve's Independent Monetary Strategy:

As the central bank, the Federal Reserve has a strong degree of independence in its monetary policy, with its main responsibility being to control money supply through adjusting the federal funds rate and open market operations. The quantity of base money it controls is influenced by two main factors:

-

Changes in Federal Government Debt: The Federal Reserve injects base money into the market by purchasing government bonds and other assets.

-

Open Market Operations: The Federal Reserve adjusts the amount of base money by buying and selling short-term government bonds.

The scale of base money in the U.S. is usually greatly influenced by global demand for dollars, as the dollar is the world's primary reserve currency. The global liquidity demand for dollars can affect the issuance of base money, especially during periods of global economic instability, when the Federal Reserve may increase its money supply accordingly.

- Federal Reserve Characteristics: Debt-driven

The U.S. currency supply is closely related to the issuance of government debt. The Federal Reserve adjusts base money by purchasing or selling government bonds while determining credit expansion through market mechanisms.

- The International Reserve Currency Status of the Dollar: ==Underlying Reasons==

The issuance of U.S. currency is largely supported by the dollar's status as a global reserve currency. The demand for dollars from other countries allows the Federal Reserve to achieve liquidity expansion through monetary easing without easily triggering domestic inflation. (The whole world is indebted to the U.S.)

Further Expansion: Issued Currency (Broad Money, such as M2)#

Issued currency refers to the money created by commercial banks through loans, credit, and other means based on base money.

China:

In China, loans from commercial banks constitute the main source of broad money. Banks convert base money into broad money through the money creation process, and the high loan-to-deposit ratio in the Chinese banking system means that the lending behavior of commercial banks significantly impacts M2 growth.

China's broad money has grown rapidly, especially in the past decade, with M2 growth generally outpacing GDP growth, reflecting the strong support of the Chinese financial system for economic growth.

United States:

Broad money in the U.S. is also primarily achieved through credit expansion in the banking system. However, due to the relatively developed capital markets in the U.S., the incremental part of broad money also comes from innovations in financial products such as stocks and bonds, not just traditional bank deposits and loans. Therefore, M2 growth is influenced by multiple factors, including capital markets and financial instrument innovations.

The money supply in the U.S. often experiences significant expansion during financial crises or periods of economic stimulus (such as quantitative easing after the 2008 financial crisis), especially as the Federal Reserve's monetary policy directly affects the scale of broad money through market operations.

The scale of issued currency directly depends on the money multiplier (i.e., the multiple effect of money supply). The money multiplier reflects the multiple effect of base money being converted into broad money through the banking system's loans, deposits, and other processes. It is determined by various factors, including banks' lending capacity, reserve requirements, and liquidity in the money market.

Money Multiplier#

China's Money Multiplier (==This part is directly displayed, with a summary table later, the same for the U.S.==)

China's money multiplier is relatively large, typically between 5 and 7 times. This is mainly due to several factors:

-

High Loan-to-Deposit Ratio: The Chinese banking system tends to use most deposits for lending, especially in state-owned and large commercial banks, where the amount of money created through loans is relatively large.

-

Reserve Requirements: Although the People's Bank of China uses the reserve requirement ratio as one of its main monetary policy tools, the relatively high reserve ratio still allows banks to create more broad money through credit expansion. Especially in the absence of severe credit tightening, banks' credit expansion significantly amplifies base money.

-

Local Government Financing Platforms: Local governments attract funds through borrowing channels (such as local government bonds and platform companies), which further promotes the expansion of broad money.

United States' Money Multiplier

The U.S. money multiplier is relatively small, typically between 2 and 3 times. The reasons mainly include:

-

Developed Capital Markets: In the U.S. financial system, capital markets (such as bonds, stocks, etc.) play an important role, and the speed of credit expansion is relatively slow. Even if base money is injected into the market through the Federal Reserve's operations, the influence of capital markets leads to relatively slow credit and deposit expansion.

-

Bank Reserve Management: The U.S. banking system implements a more flexible reserve management system, allowing banks to use fewer deposits for lending due to the lower statutory reserve requirements set by the Federal Reserve. However, U.S. banks tend to hold higher liquidity reserves, unlike China, which limits the expansion of the money multiplier.

-

Tightening of Credit Policies: U.S. banks often adopt more cautious lending policies during periods of economic uncertainty, which limits further amplification of the money multiplier.

Other Factors Affecting the Money Multiplier#

In addition to reserve requirements, lending tendencies, and the development of capital markets, some external factors can also affect the money multiplier:

- Economic Environment:

China: When economic growth is strong, the demand for bank loans increases, and the money multiplier may rise. However, if the economy faces a slowdown or increased financial risks, banks may tighten lending, leading to a decrease in the money multiplier.

United States: During economic crises or market turmoil, the Federal Reserve significantly increases base money through quantitative easing and other measures, but since banks are reluctant to lend excessively (especially after the financial crisis), the money multiplier is usually low.

- Credit Quality and Market Expectations:

China: If the risk of default increases for local governments and enterprises, banks may raise the risk premium on loans, reducing credit supply and thus lowering the money multiplier.

United States: Similarly, credit crises (such as the 2008 financial crisis) lead banks to increase the risk premium on loans, reducing lending, which also results in a decrease in the money multiplier.

Summary Comparison#

| Aspect | China | United States |

|---|---|---|

| Base Money | Mainly adjusted through foreign exchange occupation and central bank operations, influenced by external factors | Operated by the Federal Reserve through purchasing government bonds, significantly influenced by global demand |

| Issued Money (M2) | Relies on bank credit expansion, with a rapid growth rate of broad money | Developed capital markets, with broad money growth influenced by various financial innovations |

| Money Multiplier | Relatively large, typically 5-7 times, influenced by high loan-to-deposit ratios and local government financing | Relatively small, typically 2-3 times, influenced by capital markets and tightening credit policies |

| Influencing Factors | Reserve ratios, loan-to-deposit ratios, local government financing platforms, etc. | Bank credit policies, capital markets, reserve management, etc. |

Overall, China's money multiplier is relatively high, primarily driven by credit expansion and high bank savings, while the U.S. money multiplier is low, due to developed capital markets and slower bank credit expansion.

4. Monetary Policy Tools and Operations#

[Note]: The image is from the official website of the People's Bank of China - Monetary Policy (http://www.pbc.gov.cn/rmyh/105145/index.html)

China: More reliance on quantitative tools

-

Reserve Requirement Ratio: The reserve requirement refers to the proportion of deposits that commercial banks must hold at the central bank. This is one of the core tools of China's monetary policy, controlling money supply by adjusting the reserve requirement ratio of commercial banks. The term "reserve requirement reduction" refers to the central bank releasing liquidity into the market to stimulate economic recovery.

-

Re-lending and Rediscounting: Rediscounting refers to commercial banks submitting outstanding bills to the central bank for discounting to obtain short-term funding support. The discount rate is the interest rate charged by the central bank when providing funds to commercial banks. The People's Bank of China stimulates credit issuance by providing low-cost funds to commercial banks. For example, the central bank supports specific sectors such as small and micro enterprises, agriculture, and green finance through re-lending and rediscounting.

-

Open Market Operations: The central bank adjusts market liquidity and money supply by buying and selling government bonds or other financial assets in the open market. For instance, the People's Bank of China adjusts short-term liquidity through reverse repos and repos, and recently, to adjust capital market liquidity, the state has provided trillions of yuan in funding to attempt to stabilize the market.

Limited Interest Rate Tools:

China's interest rate marketization is still in progress, and the central bank indirectly influences credit costs by adjusting policy interest rates (such as the Medium-term Lending Facility (MLF) rate and Loan Market Quote Rate (LPR)), but the transmission mechanism is not as flexible as in the U.S.

United States: More reliance on price-based tools

-

Policy Interest Rate (Benchmark Rate): The benchmark interest rate set by the central bank, usually a short-term rate (such as China's Loan Market Quote Rate (LPR) and the U.S. federal funds rate).

- Mechanism of Action:

- Increasing the Benchmark Rate: Loan costs rise, reducing the willingness of enterprises and residents to finance, leading to decreased consumption and investment, cooling the economy.

- Lowering the Benchmark Rate: Loan costs decrease, increasing the willingness of enterprises and residents to finance, leading to increased consumption and investment, expanding the economy.

- Application Scenario: The Federal Reserve directly influences market interest rates and economic activity by adjusting the target range of the federal funds rate.

- Mechanism of Action:

-

Interest Rate Corridor: The central bank sets upper and lower limits to form an interest rate range, guiding fluctuations in short-term market interest rates.

- Mechanism of Action:

- Lower Limit: Usually the central bank's deposit rate (the return rate for banks depositing at the central bank).

- Upper Limit: Usually the central bank's loan rate (the cost for banks borrowing from the central bank).

- Application Scenario:

- China: Constructed a similar interest rate corridor framework, guiding short-term interest rates through Standing Lending Facility (SLF) and deposit rates.

- United States: The Federal Reserve constructs an interest rate corridor using the Interest on Excess Reserves (IOER) and the discount rate.

- Mechanism of Action:

Interest rate regulation is the main tool of the Federal Reserve, especially the adjustment of the target range for the federal funds rate, used to guide short-term interest rates and indirectly influence long-term rates.

- Quantitative Easing (QE): During economic crises, the Federal Reserve injects liquidity into the market by purchasing large amounts of government bonds and mortgage-backed securities (MBS).

Flexible Market Mechanism:

The U.S. financial system is highly market-oriented, and the transmission efficiency of monetary policy tools is high. Moreover, the Federal Reserve can quickly adjust the money supply through open market operations, and if necessary, can issue government bonds to allow global countries to help the U.S. repay its debts.

Characteristics and Differences of Monetary Policies between China and the United States#

| Tool/Operation | China | United States |

|---|---|---|

| Reserve Requirement Ratio | Frequently adjusted, as an important quantitative tool, gradually reduced in recent years to release liquidity | Used less frequently, relying more on interest rate tools |

| Rediscount Rate | Supports specific industries and sectors (such as SMEs, green finance), with a more targeted rediscount policy | Used less frequently, but becomes an important tool for liquidity support during financial crises |

| Open Market Operations | Focused on short-term liquidity adjustment, achieved through reverse repos, repos, and MLF | Focused on medium- to long-term goals, influencing money supply and interest rates through buying and selling government bonds |

| Interest Rate Tools | Interest rate marketization is progressing, with MLF and LPR gradually becoming the main interest rate adjustment tools | Mainly adjusts through the target range of the federal funds rate, with a mature interest rate transmission mechanism |

| Credit Management | Widely used in the past, gradually marketized in recent years, but still has administrative intervention in credit policies for specific sectors (such as real estate) | Fully marketized operations, relying on market-based methods for credit management |

| Foreign Exchange Intervention | Influences money supply through foreign exchange occupation, gradually decreasing in recent years | The Federal Reserve intervenes in the foreign exchange market infrequently, focusing more on the domestic market |

Reasons for Differences in Total Currency Volume and Structure between China and the United States#

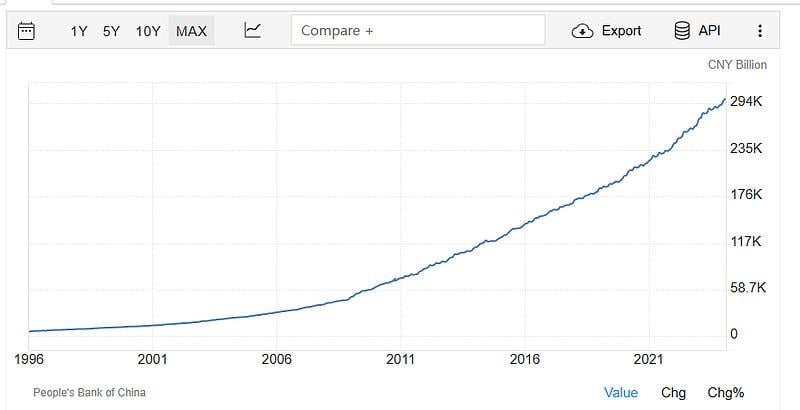

In April of this year, the central bank announced that China's broad money M2 exceeded 300 trillion yuan in March. Since this is a round number, and it took 57 years for China to break the first 100 trillion, 7 years for the second 100 trillion, and only 4 years for the third 100 trillion, it has sparked a lot of media commentary.

- One particularly eye-catching statement is that China's total currency volume far exceeds that of the U.S., essentially equivalent to the combined total of Japan and Europe, suggesting that the Renminbi could buy all dollars, yen, and euros.

- An article in the professional financial publication "The Banker" stated that by the end of May 2024, China's total M2 would be approximately $41.67 trillion. By the end of April 2024, the U.S. M2 balance was $20.97 trillion, indicating that China's M2 balance is nearly double that of the U.S. (i.e., twice that of the U.S.); while the combined M2 of the U.S., Eurozone, and the UK is $41.43 trillion, China's M2 is already equivalent to the total of the U.S., Eurozone, and the UK.

- Although the numbers listed by the author of the article are not incorrect, the M2 data of China and other countries, especially the U.S., lack comparability.

The main reasons are as follows:

-

The statistical caliber of M2 in China and the U.S. is inconsistent: the U.S. M2 caliber is much narrower than that of China.

From the perspective of categories, China's M2 includes not only narrow money M1 and personal savings and unit time deposits but also quasi-money such as margin deposits, money market funds, and provident funds, while the U.S. M2 does not include margin deposits and provident funds, and money market funds only account for retail, excluding the portion held by institutional entities. (This part has been explained earlier.)

-

Disappearing M3

China's M2 does not set a limit on account deposit amounts; regardless of the deposit amount, it will be included in the statistics, while the U.S. M2 only counts small deposits (time deposits not exceeding $100,000).

A rough estimate shows that if we follow the U.S. M2 category, China's M2 would decrease by at least one-third, approximately 1.2 times that of the U.S. M2, rather than the previously mentioned two times ($41.67(CN)≈ 2×$20.97(USA)).

In fact, the definition of U.S. M3 currency is closer to that of China's M2. The definition of time deposits exceeding $100,000 in the U.S. M3 includes large deposits, money market funds held by legal entities, and overseas dollars, which can generate a large amount of derivative currency. However, the U.S. has not published M3 since March 2006, and we do not know the exact total amount of M3 issued in the U.S. Regarding the reasons for the Federal Reserve's cessation of M3 publication 🤔: 1. The Federal Reserve believes that M3 does not contain additional economic activity information; 2. The collection cost is too high (but wedddd).

Although we cannot see the latest total data for U.S. M3, we found a growth chart for U.S. M3 online. The last time the Federal Reserve publicly disclosed the total amount of U.S. M3 was in 2005, when the disclosed balance was approximately $10.3 trillion. From the growth situation, it is not difficult to judge that the latest balance of U.S. M3 is a staggering number.

- The different financial market structures between China and the U.S. lead to different financing methods.

China primarily relies on indirect financing, meaning that the banking system acts as an intermediary, and the credit creation process mainly depends on bank credit issuance, which in turn continuously generates new deposits; the main form of residents' financial assets is also bank deposits, all of which are included in M2.

The U.S. primarily relies on direct financing, which is a market-driven standard model, where the credit creation process relies more on direct financing methods such as the bond market, which does not generate M2; the main form of residents' financial assets is also securities, such as stocks and bonds, which are not included in M2.

A few years ago, the total scale of the U.S. stock and bond markets had already exceeded $100 trillion, which is significantly higher than the total of China's M2 + stock market + bond market. If we combine direct and indirect financing for a total scale comparison, the U.S. far exceeds China.